The Philippine Insurance Commission reports a notably low insurance penetration rate of 1.75 in the country. However, the increasing digitalization and improving financial literacy among Filipinos are anticipated to significantly boost this figure. Encouraging the insurance industry to contribute to spreading financial literacy, the Commission emphasizes the importance of enhancing financial inclusion nationwide.

Responding to this call to action, the Palawan Group of Companies, renowned for its expertise in pawning and financial services, is taking proactive steps to improve insurance accessibility in the Philippines. This initiative involves the expansion of its ProtekTODO microinsurance products through various channels.

Palawan ProtekTODO offers an extensive microinsurance solution designed to provide flexible and affordable coverage against unforeseen accidents for Filipinos. It caters to individuals, students, families, small to medium business owners, companies, and household helpers, safeguarding them against a wide range of mishaps including natural disasters, accidental death, fire hazards, and more. The policies cater to diverse needs such as emergency hospitalization, dengue, pet coverage, and protection for pawned items. With coverage options ranging from Php15,000 to Php100,000, available for as little as P20, Palawan ProtekTODO prioritizes accessibility and flexibility.

Backed by reputable insurance companies such as Liberty Insurance Corporation, AlliedBankers Insurance Corporation, and Generali Life Assurance Philippines, Inc., Palawan ProtekTODO ensures the reliability and integrity of its coverage, offering policyholders peace of mind and financial security.

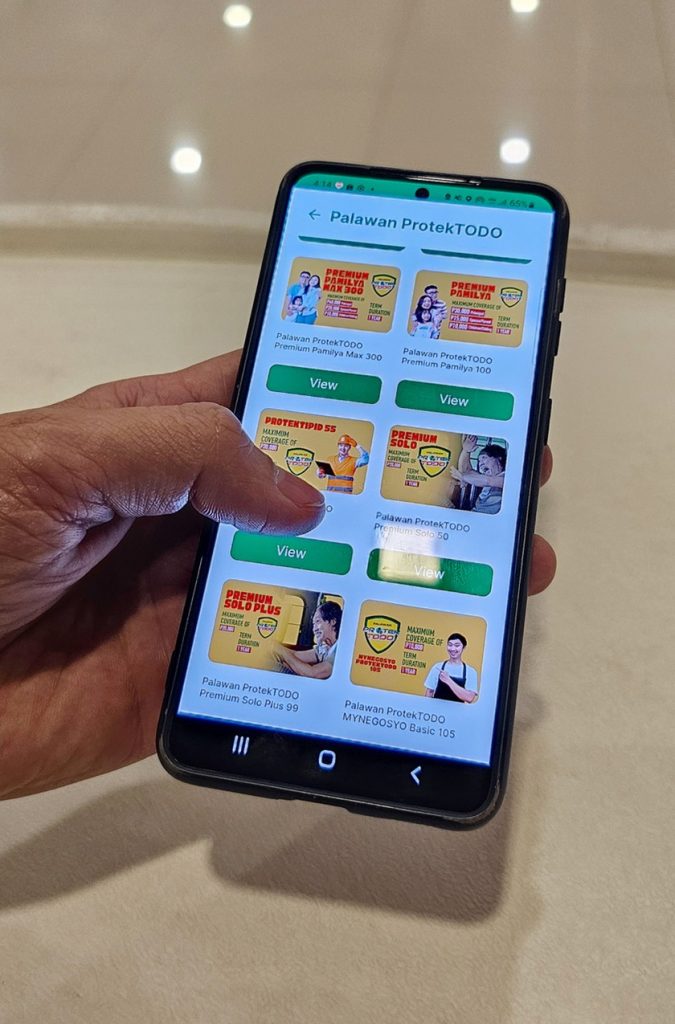

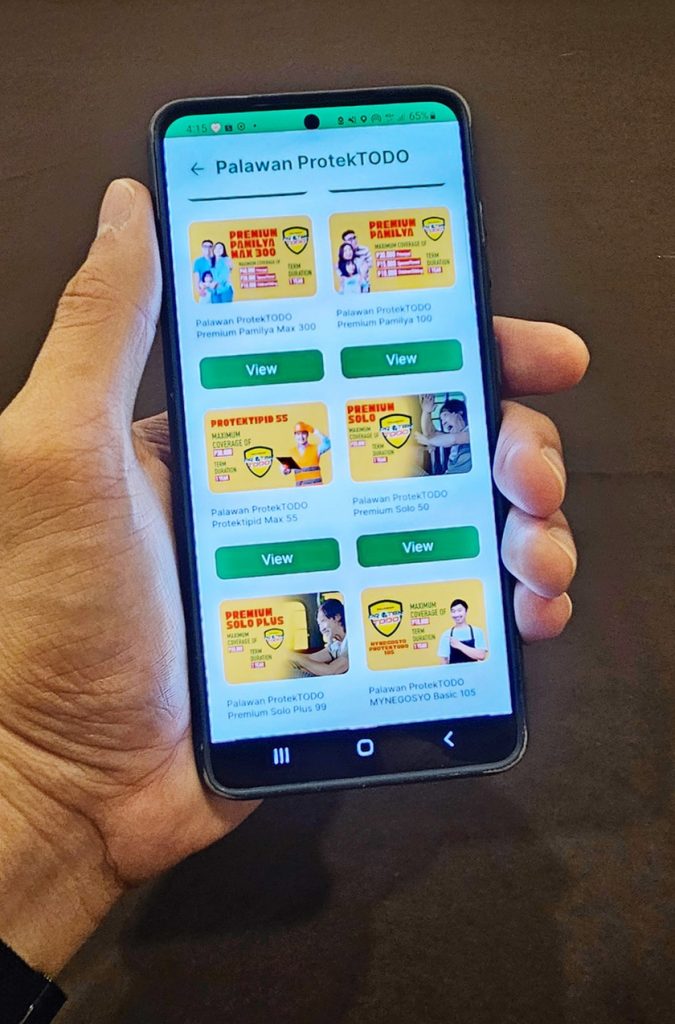

In addition to its network of over 3,300 physical stores, Palawan Pawnshop now offers Palawan ProtekTODO insurance through the PalawanPay app and various e-commerce platforms like Lazada and Shopee. This enables Filipinos to easily access personal insurance with just a few clicks, ensuring protection for themselves and their families against life’s uncertainties.

Sukis can now avail themselves of microinsurance coverage at the branch, through the app, or online, allowing them to choose the most convenient channel to secure their coverage. This further enhances Palawan Pawnshop’s commitment to serving the needs of its sukis.

Bernard Kaibigan, Enterprise Marketing Head for Remittance and Auxiliary Services at the Palawan Group of Companies, emphasized, “In our dedication to meeting the evolving needs of our valued customers, we strive to offer affordable, flexible, and easy-to-understand insurance policies. Our goal is to ensure the protection of our customers and their families, providing them with peace of mind. Whether it’s unexpected medical expenses or unforeseen accidents, Palawan ProtekTODO is designed to provide coverage for life’s uncertainties.”

As one of the fastest-growing financial institutions in the country, the Palawan Group of Companies boasts over 25,000 branches, Pera Padala outlets, and PalawanPay money shops nationwide. The company remains committed to promoting financial inclusivity by offering affordable, flexible, and accessible insurance products and services to its customers. Through initiatives like Palawan ProtekTODO, the organization aims to make insurance accessible and affordable for all Filipino families.

To take the first step in securing your future, download the PalawanPay app from the Apple Store, Huawei App Gallery, or Google Play Store. With Palawan Pawnshop’s ProtekTODO Personal Accident Insurance, protecting yourself and your loved ones has never been easier. For more information, you can visit https://www.palawanpay.com/insurance-from-palawan-protektodo/ and you can choose and add to cart your preferred insurance policies at Lazada and Shopee. Abot Kaya at Todo Proteksyon ng mga Pilipino sa Palawan Protektodo! (Palawan Protektodo offers affordable and flexible insurance coverage for Filipino families).