Enjoy online shopping insurance with PayMaya’s Buyer Protect

PayMaya users can now enjoy better peace of mind when shopping online with Buyer Protect, the only online shopping insurance provided at no additional cost by an e-wallet in the country. Buyer Protect is underwritten by leading general insurer AIG Philippines Insurance and developed by PayMaya with leading international insurtech, bolttech.

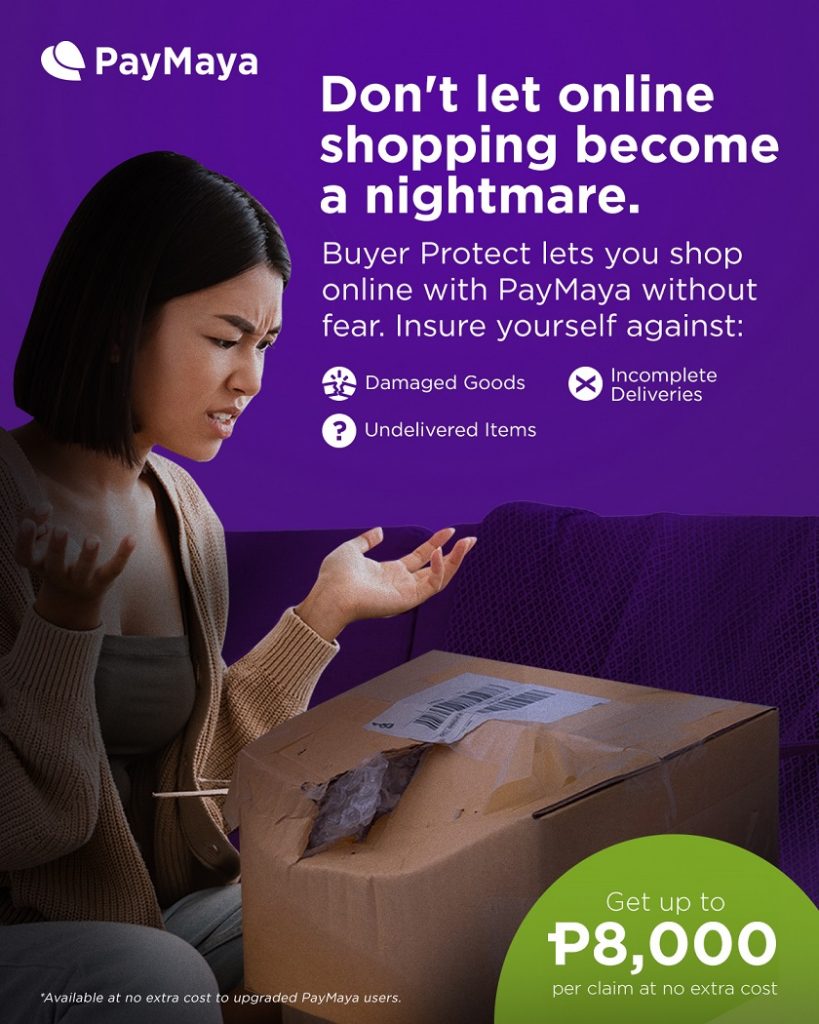

If you shop online and pay using your PayMaya account, you now enjoy peace of mind for undelivered, incomplete, or damaged purchases. This is because you are now covered – thanks to Buyer Protect. Best of all, you can take advantage of this offer at no extra cost!

With Buyer Protect Insurance, you can enjoy coverage for purchases with a minimum spend of PHP100 per transaction from legitimate online sellers with their own website or official stores on Lazada, Shopee, Instagram, Facebook Marketplace, and similar sites.

Easily get your money back if you experience online shopping fails – be it new home décor items delivered to you with damages or incomplete items from your recent shopping haul. If the seller is not willing to provide a refund, you can get it conveniently with PayMaya’s Buyer Protect!

You can get reimbursed up to PHP8,000 per valid claim, or up to PHP16,000 annually for undelivered, incomplete, or damaged purchases from eligible online sellers. To access this free insurance product, you just have to make sure that you have an upgraded PayMaya account and that you use your PayMaya card, QR code or mobile number for your online purchase.

The launch of this new offer is just one of the many ways PayMaya is making online transactions safer for you. In December 2021, the company also introduced PayMaya Verified Sellers, making it the only e-wallet that provides a special badge to legitimate and trustworthy online sellers. With this, it is easier to know if the casual seller you are paying is legit!

“More Filipinos are now enjoying the convenience of online shopping using PayMaya. That’s why we need to create more positive experiences for consumers when they purchase online, and PayMaya is leading at this front with relevant features such as Buyer Protect,” said Shailesh Baidwan, President of PayMaya Philippines.

“With Buyer Protect, our customers have better peace of mind using their PayMaya accounts as they can get reimbursed for online shopping fails without having to pay extra charges,” he added.

To enjoy worry-free shopping and experience safer and more convenient payments with a few taps on your smartphone, just download the PayMaya app and register for free!

To file a claim for your online shopping fails, simply follow these three easy steps:

- Hop over to https://www.paymaya.com/buyer-protect where you can download the claim form.

- Once you have filled out the necessary information in the form, submit it, along with the supporting documents at aigphl_consumerclaims@aig.com.

- All that’s left to do now is wait for the reimbursement in your PayMaya account in 7 – 10 working days.

The launch of Buyer Protect is part of PayMaya’s push to make digital transactions more convenient and safer for more Filipinos. Last year, PayMaya launched Personal Protect, which covers dengue, COVID-19, and Permanent Total Disability, underwritten by Pioneer Insurance & Surety Corporation. The company also introduced Mobile Protect, which allows users to avail themselves of mobile phone repair services from bolttech for Cracked Screen or Accidental and Liquid Damage.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, communities, and government.

As of end-December 2021, PayMaya provides more than 44 million Filipinos access to financial services through its consumer platforms. Its Smart Padala by PayMaya network of over 63,000 partner agent touchpoints serves as last-mile digital financial hubs in communities, providing the unbanked and underserved access to digital services. Through its enterprise business, it is the largest digital payments processor for key industries in the country, including “every day” merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.