Through an immersive experience, the financial superapp recognizes the Filipino’s hard work and shares its latest suite of lending products to help them reach their goals faster

“Libre lang mangarap” as the saying goes. However, there is undeniable power in our dreams, and transforming them into reality becomes a lot more achievable when you receive the necessary assistance.

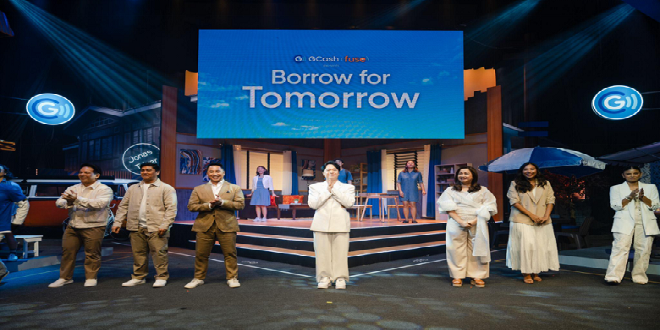

This is the core message conveyed by the pioneering finance superapp, GCash, during its event, GCash x Fuse: Borrow for Tomorrow. The immersive product showcase took place at the Maybank Performing Arts Theater on August 30. Driven by its mission to promote financial advancement for all, GCash, in collaboration with its lending subsidiary, Fuse Lending Inc., reintroduces its lending offerings: GLoan, GGives, and GCredit. Additionally, they unveiled their latest innovation: GCash Sakto Loans, a nano-loan designed to make it easy for GCash users to borrow small amounts, commonly referred to as ‘pambale.’

Produced by Yaparrazi Events and scripted by Cathy Azanza-Dy, “Borrow for Tomorrow” unveiled narratives featuring ordinary Filipinos, unfolding in the backdrop of Barangay Pag-Asa. The stage design drew inspiration from the lively and vibrant aspects of a typical Filipino community, where dreams, whether grand or modest, come to life.

“At the heart of our interactive product showcase are the stories of everyday Filipinos, and our inspiration stems from two uniquely Filipino concepts. While the notion of ‘tingi’ typically involves acquiring small quantities for immediate needs, we acknowledge that even these minor acts of support can ignite the realization of significant dreams,” stated Tony Isidro, CEO of Fuse. “These principles, along with our intrinsic spirit of bayanihan, enable us to champion the collective strength required to achieve our aspirations. It is through these distinct commonalities that we unite as a nation and weave tales of progress.”

In their modest and snug household, Mila, the supportive mother, ponders how she can replace her son’s charger-dependent laptop without depleting her savings. For significant acquisitions, GCash presents GGives, a convenient and adaptable installment plan that permits eligible users to buy high-value items totaling up to P125,000 and settle the payment over a span of up to 24 months. With no initial downpayment required and no additional documentation necessary, diligent parents like Mila can enhance their quality of life without straining their finances.

Outside, Rowena, the family’s breadwinner and side hustler, is eagerly awaiting her salary and commission. She’s in search of a financial lifeline, often referred to as ‘pantawid,’ to settle her utility bills and stock up on groceries. GCredit, powered by CIMB, serves as an ever-available credit line, extending up to PHP 50,000, not just for times of financial tightness but also for everyday emergencies. With its straightforward application process, favorable interest rates as low as 5% per month, and convenient payment terms, hardworking individuals like Rowena can effortlessly manage their expenses by covering utility bills and grocery expenses.

Teresa, the proprietor of a local eatery, and Isko, a dedicated delivery rider, share a common dream of accumulating sufficient capital to take Aling Teresa’s Cafe to the next level. Catering to budding entrepreneurs and small business proprietors, GLoan provides instant cash, with amounts extending up to P125,000, directly credited to eligible users’ GCash wallets. This financial boost can serve as ‘pampuhunan’ for commencing or expanding a business, whether it involves upgrading equipment or investing in skills enhancement.

Meanwhile, over at the neighborhood convenience store, Lito finds himself in need of borrowing two kilos of malagkit rice, hoping that his friend Inday will once again come to his aid. Much like Lito, many Filipinos still find themselves searching for ‘pambale’ when their finances become tight. However, they often feel reluctant to do so due to the fear of being judged. Additionally, not everyone has the privilege of having colleagues, friends, or family members who can provide financial assistance. With GCash Sakto Loans, GCash presents users with a hassle-free solution to borrow small sums of money, which can be employed for cash needs or to cover various GCash transactions, both online and offline.

Saktong Pambale with Sakto Loans

Nine out of every ten Filipinos find themselves in situations where they need to borrow money. However, the topic of loans continues to be somewhat of a social taboo, leaving many individuals feeling embarrassed about the possibility of being perceived as unable to manage their finances or as a burden to others. Fuse recognizes that borrowing money is an integral part of life, and more Filipinos should have access to equitable, straightforward, and inclusive loan opportunities. This is precisely why Fuse has assisted over 3 million Filipinos in realizing their aspirations by disbursing over PHP 100 billion in loans since 2016.

“We firmly believe that Filipinos deserve improved access to equitable loans that can accelerate their journey towards realizing their dreams. At Fuse, we are committed to simplifying the borrowing process, enabling individuals to allocate their resources towards fulfilling their ambitions, whether big or small,” expressed Isidro. “We achieve this by offering lending products that are hassle-free from application to disbursement and payment. There are zero additional documents required, no waiting time for eligible customers, and select popular offline and online stores offer zero interest.”

With the introduction of GCash Sakto Loans to their extensive range of lending solutions, GCash and Fuse aspire to diminish the stigma associated with borrowing. Users can now do away with any feelings of shame when they find themselves in need of ‘pambale.’

GLoan Sakto and GGives Sakto empower users to borrow amounts as low as PHP 100, going up to PHP 1,000, with a 15% processing fee and no interest. Repayment can be made either on the 15th or at the end of the month. Sakto Loans serve as an entry-level or ‘buena mano’ loan option for those who are not yet eligible for GLoan and GGives.

Much like how the characters in everyday life go out of their way to assist each other in meeting their daily necessities and pursuing their grander aspirations, Borrow for Tomorrow celebrates the unwavering spirit of Filipino bayanihan. GCash and Fuse aspire to be there for individuals like Mila, Rowena, Teresa, Isko, and Lito, providing them with the boost they require to elevate their lives, manage daily expenses, and achieve their aspirations.

Users can access GGives, GLoan, and GCredit via the GCash dashboard or find them under the “Borrow” section. For those without GCash yet, the GCash App can be downloaded from the Apple App Store, Google Play Store, or Huawei App Gallery. Kaya mo, i-GCash mo!