AKIN provides individuals with full control over their digital identities

UBX, the premier open finance platform in the Philippines, has launched its decentralized identity management system, AKIN, which gives individuals complete control over their personal information and enables them to transact securely and freely with one digital identity. AKIN is an example of self-sovereign identity (SSI), a digital movement that acknowledges the power of individuals to own and control their identity without any outside administrative authorities.

With SSI, users have the ability to manage their own information and determine who has access to it, anywhere and at any time. This shifts the management of identity and credentials from a client-server model to a peer-to-peer model. Simply put, SSI provides individuals greater control over their data, allowing them to select which companies, entities, or individuals can use it.

For instance, an individual with SSI processed through a participating bank can use their SSI to apply for a postpaid line with a local telecom company, eliminating the need to fill out forms and reducing the friction and duplication that often arise in companies’ know-your-customer (KYC) processes.

AKIN complements the Philippine Identification System (PhilSys), a project of the Philippine government, which aims for financial inclusion, a goal that is also at the heart of UBX’s mission. PhilSys allows users to decide who has access to their information when transacting using PhilSys.

“Coopetition,” a combination of cooperation and competition, is a central principle of AKIN. In other words, AKIN encourages institutions to work together in developing and operating the technical system, leading to healthy competition in the development of new products and services based on it, according to UBX President and CEO John Januszczak.

Similar to PhilID, AKIN is expected to improve the reliability of services and reduce fraud by uniquely identifying each registered individual based on a set of data, making it difficult for others to access the same credentials.

As the leading open finance platform in the Philippines, UBX prioritizes customer data security and is fully compliant with data regulation statutes and rules set by various financial institutions and service providers, according to Januszczak.

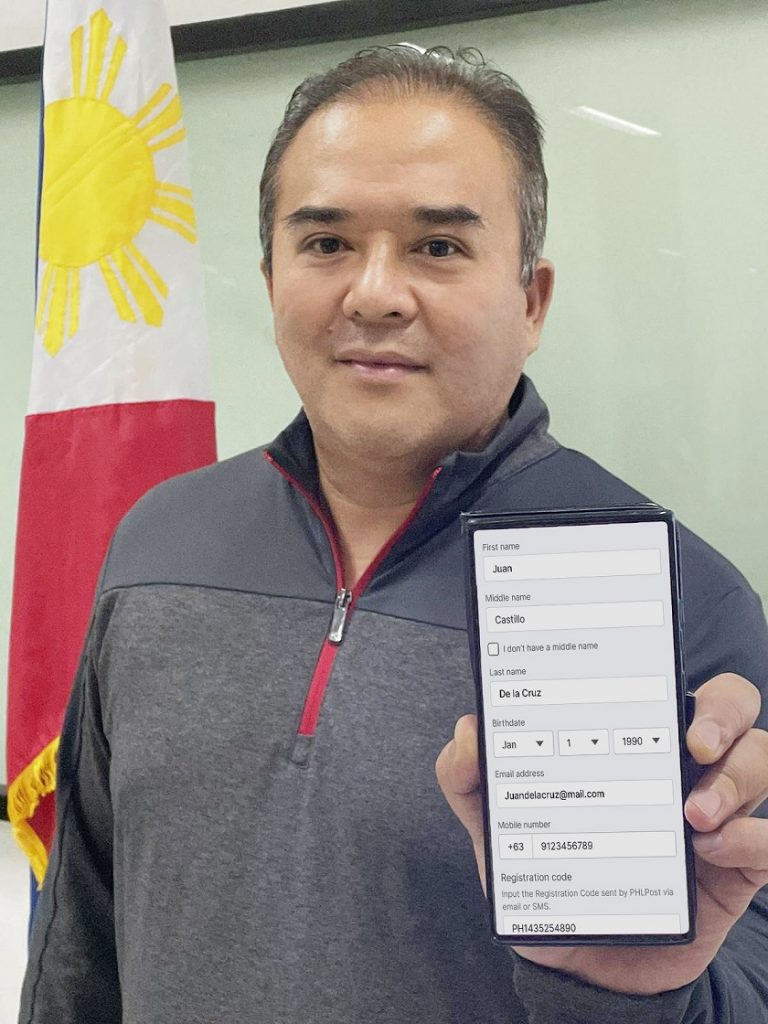

The Philippine Postal Corporation (PhilPost) is one of the first organizations to integrate AKIN into its system. PhilPost, in partnership with GRP Mobile Solutions Inc. and UBX, is developing a mobile app that will offer digital financial solutions to complement its postal services. The app, which will be launched this year, will allow users to take advantage of open finance solutions that meet their needs through integration with AKIN.

With AKIN, users can digitize their cards in their wallets to identify themselves online. By downloading one of the partner wallet apps to their mobile phones, they can receive, store, and manage their data with ease. Security is ensured through encryption to prevent third parties from creating fake user profiles, and transparency is guaranteed to both customers and companies and institutions.

“This digital transformation by UBX enables us to raise the Filipino standard of living beyond just digitizing finance. UBX is always innovating to help the public sector provide quality services for all. With AKIN, we are much closer to achieving true financial inclusion as we move towards a digital economy,” said Januszczak.