It’s all about efficiency without sacrificing security

Managing your income and expenses may seem overwhelming, but it doesn’t have to be! Fortunately, banking apps like BPI’s offer more than just a safe place to store and grow your savings; they also facilitate quick, easy, and secure transactions. Make the most of your banking experience in 2024 with these four expert tips to leverage the BPI app and optimize its functionality for your benefit.

- Keep Your BPI App Updated Bank of the Philippine Islands consistently enhances its mobile app to provide users with the best experience possible. By regularly updating to the latest version, you ensure the security of your funds and information. The app is designed to run only on secure devices, such as those operating on iOS 14, Android 8, or higher, and which are not jailbroken, modified, or rooted. For Android users, it’s essential to disable “Developer Options” in the device’s settings to further safeguard the BPI app from potential security threats.

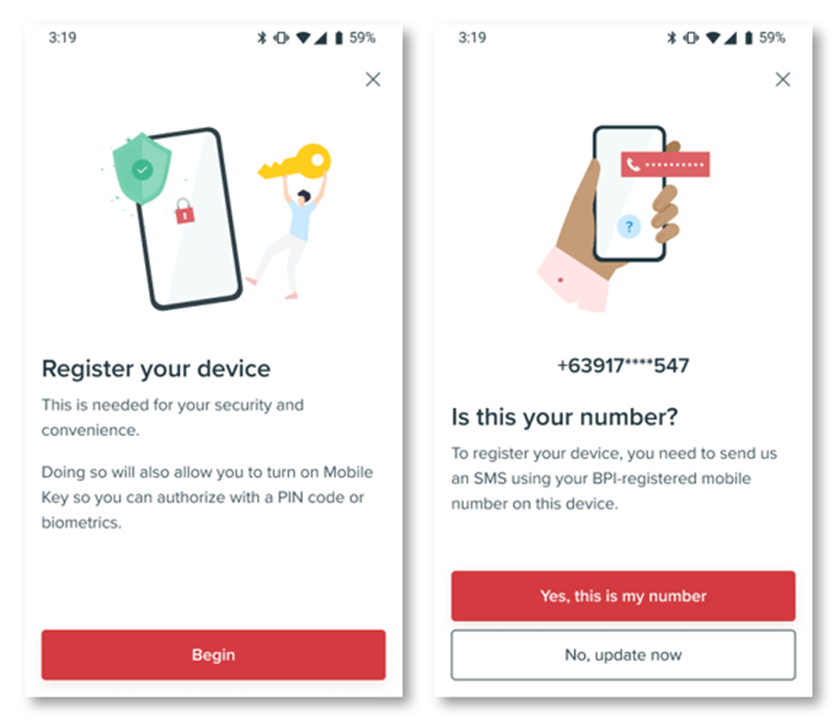

- Register Your Device with Your BPI-Registered Mobile SIM During your initial login to the BPI app, you’ll be prompted to register your device—a recent security enhancement by BPI. This additional step adds another layer of protection, ensuring that only authorized users can access your BPI account. Make sure to have your BPI-registered mobile SIM inserted into the device for seamless registration and enhanced security measures.

Hot tips:

- Before you start, make sure that your SIM has enough load to send at least 1 SMS and follow the step-by-step instructions on the app to register to device.

- Data-only SIM cards are not capable of sending SMS so you can’t use these for device registration.

- In case you want to use your BPI app on a device with a different mobile SIM or you no longer have access to your old number, you’ll need to change your registered mobile number first. Just head to online.bpi.com.ph and enter your login details. When you see the “Send SMS OTP” prompt, click “Not your phone?” Enter the details of the BPI product you have and your mobile number, and activate your new number at the nearest BPI branch ATM.

- Working abroad? You’ll need to update your registered mobile number to your current local SIM so you can register your device. You can phone a friend to update your mobile number toll-free! (As in your helpful BPI call center agent.)

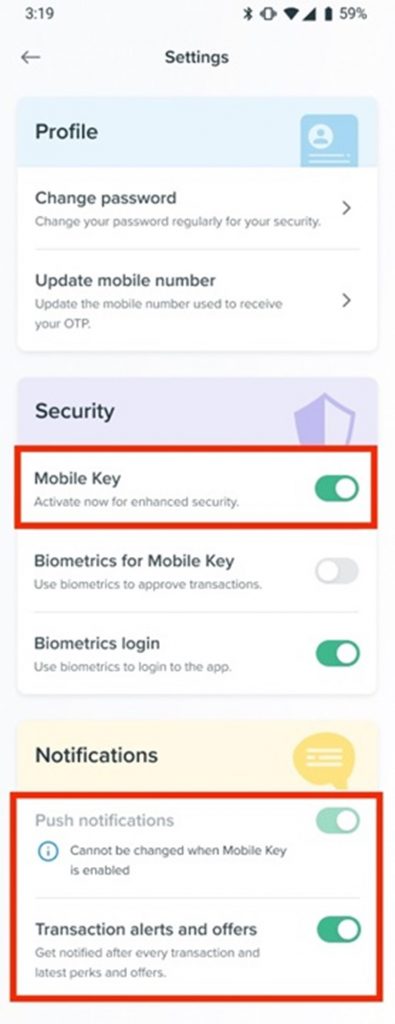

Enable Mobile Key

Activating Mobile Key enhances the efficiency and security of your transaction authorizations. By utilizing Mobile Key, you eliminate the inconvenience of waiting for OTP texts, requesting new ones when delays occur, and manually copying and pasting across applications. Who wouldn’t appreciate such convenience?

Moreover, Mobile Key functions as an additional security measure, providing BPI with assurance that you are the rightful account owner. Whether your device undergoes automatic app updates, you switch to a new device, or you access BPI online through a web browser, Mobile Key confirmation is required each time, adding an extra layer of protection to your account.

Enable “Push notifications” and “Transaction alerts and offers” in your app settings to successfully activate Mobile Key.

Pay straight from your BPI app

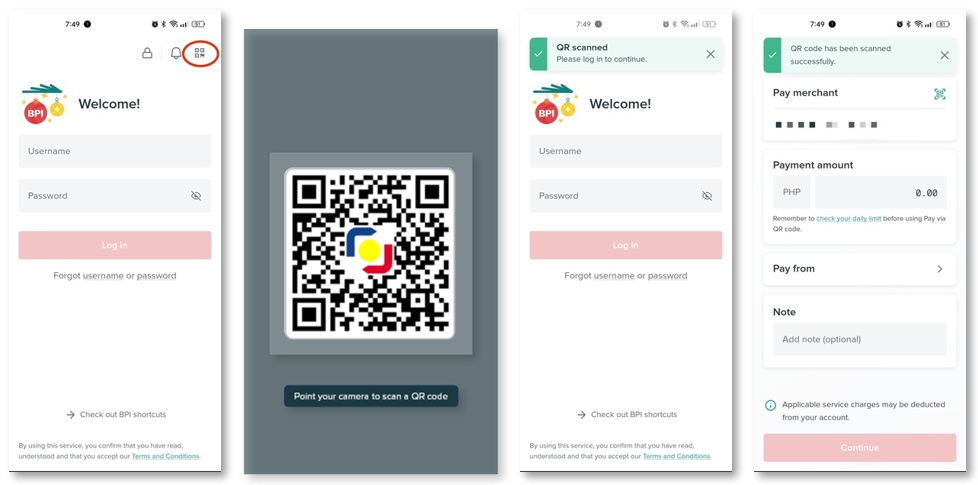

Did you know that you can now simplify your in-store payments by skipping the extra step of loading or cashing in to your e-wallets? With BPI’s pay via QR feature, you can scan any QR Ph code and complete your transaction in just four easy steps. Upon opening the app, you’ll find the quick-access QR icon conveniently located at the top right of the screen. Simply scan the QR, log in to your account, and choose the account you wish to pay from. It’s as simple as that!

Whether you’re paying with GCash, Maya, or other banks, as long as the QR code bears the QR Ph symbol in the middle, you can easily scan it using the BPI app. Give it a try at one of the thousands of stores nationwide that accept QR Ph payments!

Just a quick heads-up: transactions made using merchant QR Ph codes won’t incur any fees. You can identify a merchant QR Ph code when the top of the screen displays “Pay merchant” after scanning the QR. However, if it reads “Transfer to other banks,” it indicates a QR Ph code linked to an individual account, which may involve transfer fees, so be sure to take note of that.

For more info and BPI app troubleshooting tips, visit https://help.bpi.com.ph/s/.

You can also follow the official BPI accounts on Facebook (https://www.facebook.com/bpi) and Instagram (https://www.instagram.com/officialbpi/) to get the latest updates on the BPI app and all things BPI